AAR Announces Cash Dividend - April 2017

WOOD DALE, Ill., April 18, 2017 /PRNewswire/ -- AAR CORP. (NYSE: AIR) announced that its Board of Directors at its regularly scheduled meeting declared a quarterly cash dividend of $0.075 per share to its stockholders. The dividend will be payable on May 12, 2017 to stockholders of record as of the close of business on May 1, 2017. Future cash dividends will be subject to the approval of the Board of Directors.

About AAR

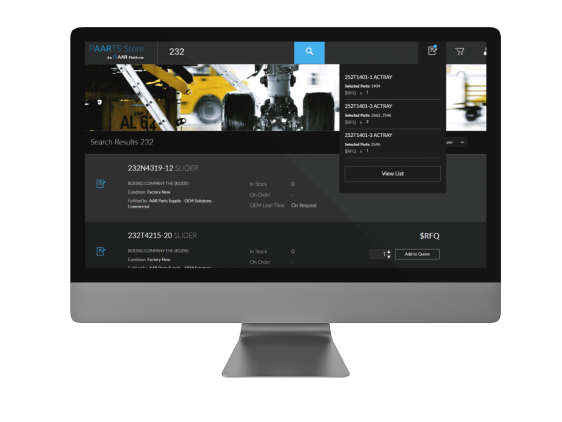

AAR is a global aftermarket solutions company that employs more than 4,500 people in over 20 countries. Based in Wood Dale, Illinois, AAR supports commercial aviation and government customers through two operating segments: Aviation Services and Expeditionary Services. AAR's Aviation Services include inventory management; parts supply; OEM parts distribution; aircraft maintenance, repair and overhaul; and component repair. AAR's Expeditionary Services include airlift operations; mobility systems; and command and control centers in support of military and humanitarian missions. More information can be found at www.aarcorp.com.

This press release contains certain statements relating to future results, which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on beliefs of Company management, as well as assumptions and estimates based on information currently available to the Company, and are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or those anticipated, including those factors discussed under Item 1A, entitled "Risk Factors", included in the Company's Form 10-K for the fiscal year ended May 31, 2016. Should one or more of these risks or uncertainties materialize adversely, or should underlying assumptions or estimates prove incorrect, actual results may vary materially from those described. These events and uncertainties are difficult or impossible to predict accurately and many are beyond the Company's control. The Company assumes no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. For additional information, see the comments included in AAR's filings with the Securities and Exchange Commission.

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/aar-announces-cash-dividend-300441223.html

SOURCE AAR CORP.

Jason Secore, Vice President, Treasurer | (630) 227-2075 | Jason.Secore@aarcorp.com

Related news

See all

April 07, 2025

AAR names Sharon Purnell Senior Vice President and Chief Human Resources Officer

Wood Dale, Illinois — AAR CORP. (NYSE: AIR), a leading provider of aviation services to commercial and government operators, MROs, and OEMs, announced that Sharon Purnell has joined the Company as Senior Vice President and Chief Human Resources Officer. In this role, Purnell will oversee the Company’s global Human Resources department, including its recruitment, talent management, and engagement initiatives.

April 07, 2025

AAR, KIRA establish KALS LLC joint venture, awarded E-6B contract by U.S. Navy

Wood Dale, Illinois — AAR CORP. (NYSE: AIR), a leading provider of aviation services to commercial and government operators, has formed a joint venture, KALS LLC, with KIRA Aviation Services under the federal government’s Small Business Administration Mentor-Protégé Program. The joint venture was recently awarded an E-6B Mercury pilot training contract by the U.S. Navy.

April 03, 2025

AAR completes sale of Landing Gear Overhaul business

Wood Dale, Illinois — AAR CORP. (NYSE: AIR), a leading provider of aviation services to commercial and government operators, MROs, and OEMs, announced today that it has completed the divestiture of its non-core Landing Gear Overhaul business to GA Telesis for $51 million.